Welcome to my first check-in for the year! Overall it’s been a good month, and I’m generally under budget for a lot of things. See below for a detailed breakdown.

January 2024 Spending

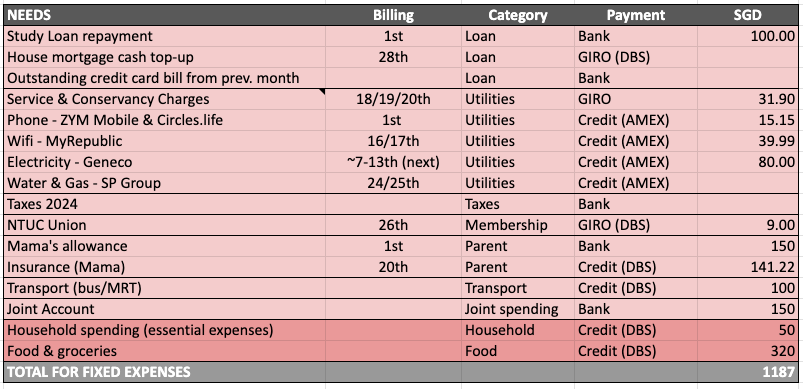

Fixed Spending (Utilities, Insurance, Transport, etc.)

Public transport: $99.53 ($120 budgeted)

Leftover: $60.82

Comments: A full month of commuting regularly adds up to roughly $100, which is good news. I can probably drop my budget to ~$110 for this.

Household Spending (Food & Household Expenses)

$500 budgeted, $339.69 spent

Food: $316.76

Dining out: $263.79

Drink: $33.70

Groceries: $19.27

Household Expenses: $13

Household toiletries: $13

Taxi: $9.93

Leftover: $160.31

Comments: I did not hold back on food spending this month and was mostly eating out instead of at home — but I still managed to keep it to ~$300! I had expected it to be much higher. I think $300-$400 would be a good amount for now, and I’ll adjust depending on the month.

Joint Account Spending (per person)

$200 budgeted per person, $245.87 spent

Entertainment: $63.50

Food & Drink: $129.26

Taxi: $21.36

Gifts: $31.75

Total: $245.87 (per person)

Comments: We were very conscientious this month with our <$20-total budget for meals! So we spent a lot less than we usually do on food. Which gives us more room and less guilt to spend on other things we like to do, like going for art events and watching movies. But anyway I transferred the difference from my Medium-term Sinking Fund.

Sinking Funds

Monthly Sinking Fund

$100 budgeted, $208.38 spent (exceeded by $108.38)

Clothes & Jewellery: $151.40

Gifts: $20

Non-essential home tools: $16.77

Sports & Exercise: $8.71

Charity, Donations, Causes: $7.02

Personal care: $3

Tech & Apps: $1.48

Comments: I think I did really well this month, despite overshooting my budget! There was one particular purchase that was about $112 towards the end of the month that caused me to exceed my budget (will explain more in the “Online Shopping Ban” section below), but generally I was being pretty frugal. I’ll offset the excess from my Medium-term Sinking Fund.

Extra “passive” income from Jan 2024

Leftover from other budgets: $221.13

Dividend payout: $115.53

Credit card cashback: $109.45

Selling: $100

Others: $72.85

Total: $546.11

Comments: I’m taking $72.85 to replenish my Health Fund, and putting the remaining ~$470 in investments.

Online Shopping Ban Report

One of my 2024 money goals is to restrict my online shopping — even though I very dramatically call it a “ban”, I’m not so strict as to never allow myself to buy anything online. I’ll explain more details in a future video.

So I’m introducing a new section in this monthly round-up where I’ll list down what I bought online, and why.

Yoga mat towel $8.71 (Shopee)

I’ve been meaning to find a yoga-mat-sized towel that I can lay over the yoga mat at the studio I go to. I couldn’t find one at Decathlon, so I looked online.

Monitor stand $16.77 (Shopee)

I needed a monitor stand for my new workplace, and this was cheaper than any of IKEA’s monitor stands (~$30). It also suited the dimensions for my specific monitor.

Protein powder: $76.49 (iHerb)

There was a 20% off sports nutrition sale, and I’ve been meaning to try protein powder for the longest time. So I decided to get it to try and I’ve been having it in the morning for a quick breakfast. This money came out of my Health Fund, which are savings (~$100) I put aside for medical or health-related expenses, including supplements like these.

UNIQLO clothes: $111.70 (ordered through app)

I needed to get a size that is only available online, but I did try the items in store. Generally I’m very picky about clothes, so when I find something I like, I will get multiples of it in different colours and wear them all until they wear out.

All in all, I think these items were very practical purchases. I was also very intentional with limiting my time on the respective platforms when selecting which one to purchase.

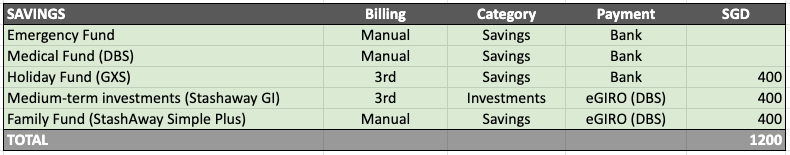

Feb 2024 Budget

Same as last month.

I have leftover U-Save vouchers this month that is enough to cover Water & Gas, so I am not budgeting for that.

Because February is a short month, I’ll try limiting my Food budget to $320, and keep my household spending to $50. That’s $370 in total.

I’m also reducing my Transport to $100, and Joint Account to $150.

No changes.

No changes.

With the extra cash from saving on Fixed Expenses, I’m putting an extra $100 in Medium-term investments and $120 in Family Fund.

I have an extra $100 going to investments, making $800 in total.

I’m looking into IBKR — I got as far as opening an account but I’m going to need more time figuring out how to use the platform. But eventually the goal is to invest about ~$1000 into CSPX.

Here are my allocation percentages this month:

I’m saving more than half my income! Woohoo!

That’s all for this month!

In case you missed it, here are my YouTube videos explaining my money goals and my budgeting framework.

My 2024 Money Goals:

How I’m budgeting my salary in 2024:

My latest net worth update (2023):

My wife and I found your YT channel some time ago. We are always so impressed by how systematic and self-disciplined you are, as well as how thoughtful and well presented your videos are. Your mother and brother are very blessed to have you!

Hello! You may consider using my ibkr referral: https://ibkr.com/referral/minyi154 No pressure though! :)